Facing Facts on Premium Increases

In case you hadn’t seen it, the Los Angeles Times had a story in Saturday’s paper profiling the rate increases of up to 86% faced by some policy-holders in California. It’s worth highlighting that one of the rate increases implemented the insurance mandates in the health care law, as well as a new state mandate that abolished premium rating based on gender (which will apply at the federal level beginning in 2014). The policyholders quoted in the piece with 70-80% increases were both male – because male premiums likely increased disproportionately under the gender rating provisions so that female rates could come down. This pattern could repeat itself under the new federal age and gender rating regulations in 2014 – with young and/or male enrollees paying more so that older and/or female policy-holders can pay less.

Other portions of the California premium increases were attributed to rising health costs. However, the Medicare actuary previously noted that the health care law will RAISE costs by $310,800,000,000, and further testified the promise that the health care law would lower costs was “false, more so than true” – meaning once again, the health care law failed to deliver.

On a related note, Secretary Sebelius has an op-ed in Politico this morning in which she makes two claims – both of which have significant flaws in their logic. First, “projections based on data from the nonpartisan Congressional Budget Office show that a family of four, making $55,000, could save more than $6,000 a year on health insurance in 2014. For a family making $33,000, those savings will be nearly $10,000 annually.” The problem is that such insurance “savings” are made possible only because the federal government is subsidizing them – and only to a select sub-group of individuals. The Congressional Budget Office found that only 19 million individuals – about six percent of the population – would be eligible for these subsidies. If the subsidies were extended to all low-income Americans, federal spending under the law would skyrocket. Moreover, those subsidies have to come from somewhere – meaning other people will pay more (i.e., higher taxes) so that a select few can pay less in insurance premiums. This strategy may “spread the wealth around,” but it doesn’t address the fundamentals of soaring insurance premiums.

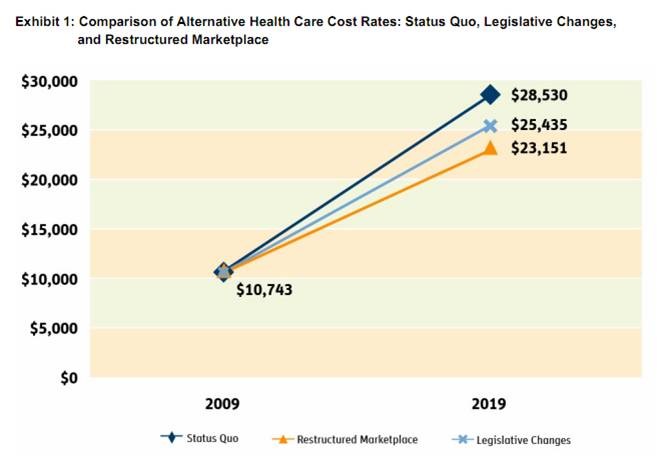

Which brings us to the Secretary’s next claim – that by 2019, efforts in the health care law to reduce costs “could save an additional $2,000 for a family policy for employer-based coverage.” The op-ed (conveniently) doesn’t cite a source on this claim, but the Administration has previously invoked a report published by the Business Roundtable in November 2009 (i.e., before the health care law was even enacted) to make this assertion. However, the Roundtable’s study only presumes a reduction in the increase of premiums. Don’t take my word for it: Look at Exhibit 1 of the study (depicted below), which study illustrates that under the maximum achievable “savings,” large employer premiums in 2019 will be $23,151 per family – or $12,408 higher than they were in 2009.

The President repeatedly promised during his campaign that he would “cut” premiums – meaning they would go DOWN, not merely just “go up by less than projected.” Once again, the skyrocketing premiums Americans are paying for health insurance in their paychecks are a constant reminder of how the health care law falls short. Sooner or later, Democrats will have to answer the question: How is a $12,400 increase in premiums – as opposed to the $2,500 reduction that candidate Obama repeatedly promised – a change that struggling middle-class families can believe in?