JEC Member Viewpoint: Sen. Jim DeMint on Obamacare’s $4 TRILLION Tax Increase

This Member Viewpoint by Sen. Jim DeMint was originally published by the Joint Economic Committee.

Highlights

- Based on CBO data, Obamacare will impose $4 trillion in new taxes by 2035.

- The “Cadillac” tax will lead to reduced medical benefits and higher taxes across all income classes.

- The “high-income” surtaxes are not indexed and will eventually hit low- and middle-income families who simultaneously receive Obamacare’s subsidies.

- Despite President Obama’s campaign promise to reduce average family premiums by $2,500, families are now paying almost $2,400 more.

- Obamacare’s $4 trillion in taxes across all sectors and income classes will diminish economic growth as the private sector faces both higher prices and lower incomes.

There are many reasons Americans dislike Obamacare: its tremendous and rising costs, which CBO recently revealed to have risen by $51 billion since just last year; the Administration’s unprecedented mandate that all employers, even religious schools and hospitals, pay for employees’ abortion-inducing drugs, sterilization, and contraception; and tens of millions of employees soon to be wondering what happened to President Obama’s promise that, “if you like your insurance, you can keep it.”1

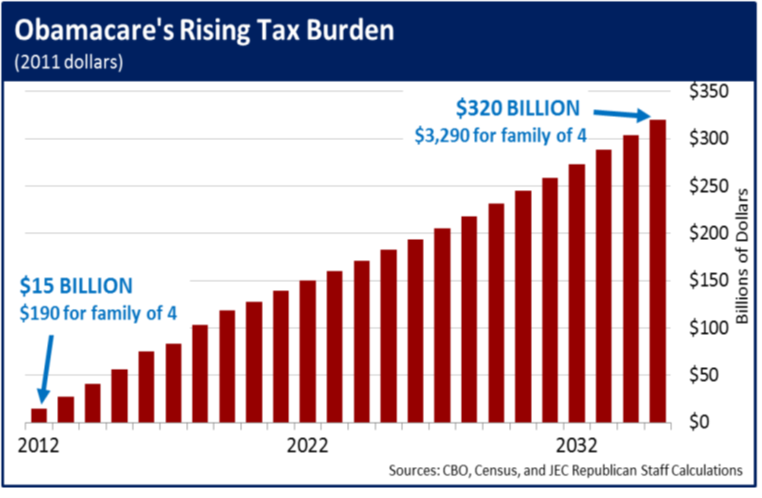

With the April 15th tax deadline just past and individuals and businesses freshly reminded of the $2.3 trillion they paid in federal taxes in 2011, Obamacare will unload an additional $4 trillion in new taxes onto the economy between now and 2035.2 The tax burden may be relatively light this year, at just $15 billion, but come 2035, that burden will be magnified more than 20-fold to $320 billion. Even if the economy in 2035 is not already crushed by the growing burden of old-age entitlements, Medicaid, and a bloated government sector consuming as much as a third of the entire economy, will it really be able to handle an additional $320 billion in new taxes – the equivalent of $3,290 for a family of four?3,4

The Administration would like you to believe that these taxes will not be paid by ordinary, middle-income Americans. Rather, they allege the taxes will be paid by insurance companies that offer “Cadillac” health plans, “high-income” earners and investors, medical device companies, insurance providers, drug manufacturers, and tanning salons. But, in reality, a substantial portion of Obamacare’s $4 trillion in new taxes will be paid by average, everyday Americans.

Take the “Cadillac” tax for example. Not only will the tax quickly begin to hit “Honda” insurance plans because its threshold is not indexed to medical inflation, but it will cause employers to reduce healthcare benefits or drop healthcare coverage entirely. Ironically, the establishment of medical loss ratios within Obamacare makes it nearly impossible for insurance companies to actually pay the “Cadillac” tax because they must devote 80% to 85% of the premiums they charge to the direct provision of healthcare benefits. When scoring the bill, the Congressional Budget Office recognized that the bulk of revenues from the “Cadillac” tax would not be paid by platinum health insurance plans, but rather by employees who are forced to exchange tax-free health insurance benefits for taxable wages after employers reduce or eliminate health insurance.

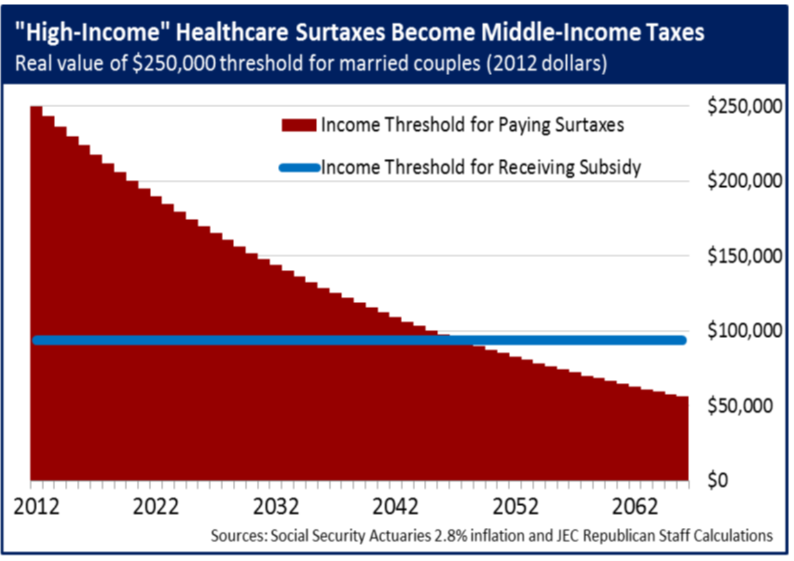

Next up are the so-called “high income” surtaxes equal to 0.9% of wages above $200,000 for individuals and $250,000 for married couples, and 3.8% of investment income above those amounts. Although classified as “high-income” taxes, the $200,000 and $250,000 thresholds are not indexed for inflation. This means that in just 10 years from now, the so-called “high-income” thresholds will have effectively ratcheted down to $152,000 and $190,000 in today’s dollars. And 40 years from now, when today’s young workers are retiring and beginning to draw down on their investment income, those thresholds will have dropped to $66,000 and $83,000 in today’s dollars.5 In other words, low- and middle-income families who receive subsidies under Obamacare will simultaneously be “high-income” earners taxed to support those subsidies.

And then there are the taxes on the healthcare industry: the insurance companies providing healthcare plans and the companies that develop and manufacture life-saving drugs and medical devices. Taxing these healthcare components will simply drive up the cost of the products and services they offer. The cost of drugs and medical devices will rise, adding a double-whammy to health insurance costs which will be driven up directly by the tax on insurance companies and indirectly by the rising cost of drugs and medical devices paid for by insurance companies.

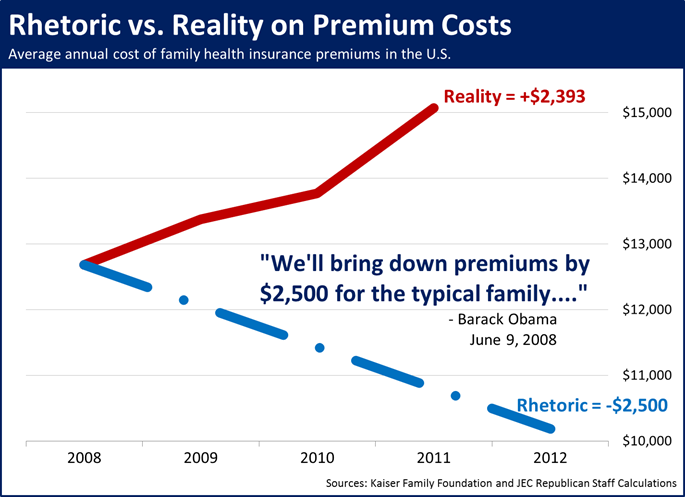

President Obama campaigned on a promise to reduce the

average family’s health insurance premium by $2,500 within his first term. Yet just the opposite has occurred – the average family is now paying $2,400 more for health insurance.6 Obamacare’s upward pressure on health insurance premiums now and into the future was confirmed by a recent estimate from the Joint Committee on Taxation which concluded that repealing Obamacare would reduce premiums by 2% – 2.5%.

Faced with higher prices across the healthcare sector, consumers will be able to deduct even less of their

healthcare expenses as the cap on itemized deductions falls to 7.5% of AGI (from 10%) and a $2,500 limit for

Flexible Spending Accounts (FSAs) is imposed.

Despite Democrats’ and the Administration’s rhetoric that we can somehow provide insurance to all by simply

holding down costs and making the wealthy pay their fair share, nothing is further from reality. Obamacare

will impose $4 trillion in new taxes on the economy between now and 2035 and these taxes will not be

restricted to the wealthy and profitable healthcare businesses. Instead, the weight of $4 trillion in new taxes

will be spread across all sectors and all income classes as incomes and economic growth decline.

1 President Barack Obama, weekly address, August 15, 2009, http://www.youtube.com/watch?v=1LRcLMScEqo.

2 The $4 trillion estimate of new taxes from 2012-2035 is based on CBO’s score of the 2012-2021 revenue provisions (represented as a percent of

GDP) contained in its estimated cost of repeal of Obamacare, including an estimate of 0.70% of GDP in 2021 (excluding the effects of the individual

mandate penalty). In CBO’s 2011 long term budget outlook, the tax provisions of Obamacare are said to rise to 1.2% of GDP by 2035. A straight-line

increase in revenues as a share of GDP, from 0.70% in 2022 to 1.2% in 2035, was applied, along with CBO’s estimates for real GDP, to generate

total tax increases from 2012-2035 of $3.989 trillion in real, 2011 dollars.

3 According to CBO’s June 2011 Long Term Budget Outlook, total federal government spending will equal 33.9% of GDP in 2035.

4 Calculation based on CBO’s projection of a $320 billion tax increase in 2035 (real 2011 dollars) and the Census bureau’s projected population

estimate of about 390 million people in 2035.

5 Estimates based on the social security actuaries’ annual inflation assumption of 2.8% for its intermediate estimates.

6 Kaiser Family Foundation, Employer Health Benefits 2011 Annual Survey, 2011, http://ehbs.kff.org/?page=charts&id=2&sn=16&ch=2116.