Comparing Deficits: Medicare and Greece

In case you haven’t been watching the stock ticker closely today, most broader market indicators are down significantly, due once again to events in Europe. Among these were today’s release of updated economic and fiscal data for members of the European Union released by Eurostat, the EU’s statistics agency. The new data found that last year, Greece ran a fiscal deficit of €19.6 billion, or about $25.7 billion at current exchange rates. Compare that to Medicare, which according to the trustees report ran an even greater deficit ($27.7 billion) in 2011. In 2010, Medicare also incurred a larger fiscal deficit than the Greek government – Greece ran a budget deficit of €23.5 billion ($30.8 billion), whereas Medicare’s deficit was a whopping $32.3 billion.

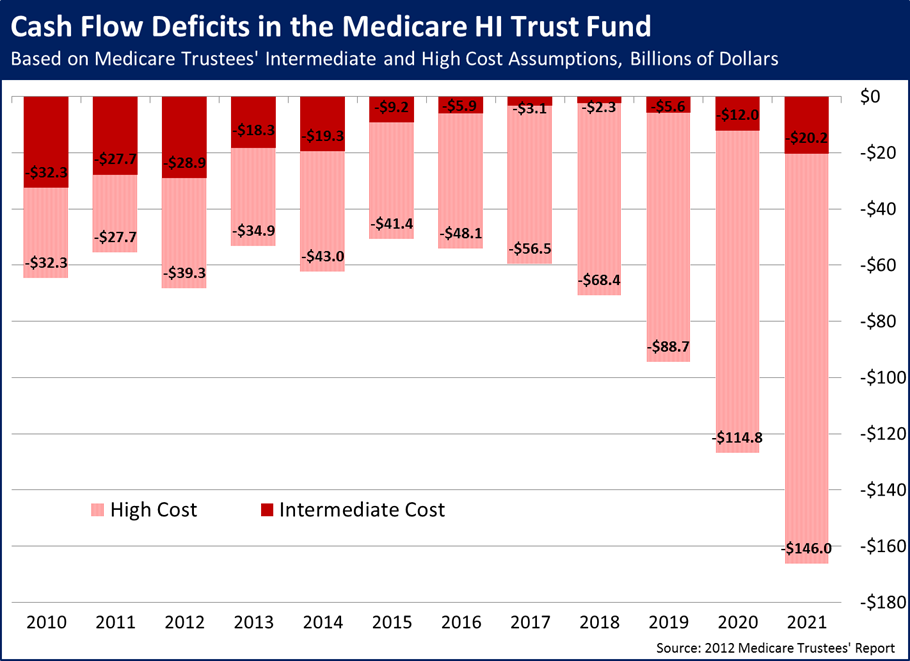

As the chart below shows, the Medicare Hospital Insurance Trust Fund is scheduled to run deficits throughout the upcoming 10-year period – and every year thereafter. And under the high-cost scenario (the pink bars in the graph), the Medicare trust fund would run out of cash in 2017, just five short years from now.

Given all this, it’s again worth asking: Where is the Democrat plan to stop all this fiscal bleeding? Some liberals argue that America is not like Europe, and does not face an impending fiscal calamity. But if Medicare is running larger deficits than the Greek government, and Senate Democrats refuse even to vote on a fiscal blueprint in the form of a budget, how will America NOT end up like the Greeks – facing an economic collapse brought on by unsustainable burdens of debt?