The Mandate and Taxes

Making the rounds on the Sunday shows yesterday, Democrats attempted to sidestep the impact of Thursday’s Supreme Court ruling calling Obamacare’s mandate a tax. But on this front, as on so many others, a good number of their claims don’t carry water. Let’s examine them one by one, using quotes from OMB Director Jack Lew’s appearance on This Week:

“The Supreme Court looked at what the structure of the law was, and they saw that 1 percent of the people would be paying this charge if they chose not to avail themselves of health insurance.”

The mandate does NOT just affect one percent of Americans. If it did, the Administration would not have gone into court attempting to claim the mandate was constitutional because it was “essential” to the larger bill – because something affecting only one percent of Americans is far from “essential.”

The mandate also affects the tens of millions of Americans who will purchase health insurance only because the federal government is forcing them to do so under pain of taxation. These individuals will be forced to buy a product they may not need, or want, just to comply with a bureaucratic diktat. Studies have found that between 8 and 24 million people would lose coverage without the mandate. These are Americans buying insurance not because they want to, but because government is forcing them to.

“These are people who can afford health insurance who choose not to buy it…”

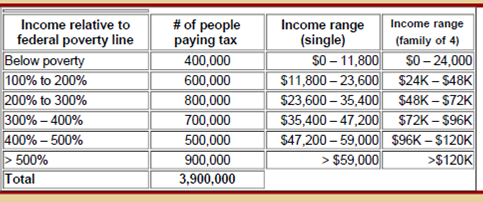

The Congressional Budget Office analyzed this issue back in April 2010. It found that more than three-quarters of individuals paying the mandate tax will have income of under five times the poverty level – or less than $120,000 for a family of four. More than 10% of individuals paying the mandate tax will have incomes below the federal poverty level, which this year is $23,050 for a family of four. Keith Hennessey laid out the numbers here, with a chart I’ve reproduced below.

These numbers raise two issues. First, does Jack Lew really believe that the 400,000 people making under $24,000 per year should be forced to pay a mandate tax because they are making a “choice” not to buy insurance policies that cost more than a new car? The second is a famous quote about the effects of an individual mandate: “There are people who are paying fines and still can’t afford [health insurance], so now they’re worse off than they were. They don’t have health insurance and they’re paying a fine.” The speaker? Barack Obama.

“In this law, there’s a $4,000 tax cut for people who need help paying for health insurance.”

According to the Congressional Budget Office, health insurance subsidies under Obamacare will total $75 billion in Fiscal Year 2016. Additionally, according to CBO, the vast majority ($58 billion in 2016, or more than three-quarters of the $75 billion total) of Obamacare insurance subsidies are pure government spending to individuals who have no income tax liability. The Joint Committee on Taxation has concluded that Obamacare will result in more than 7 million filers seeing their entire tax liability eliminated.

Liberals may claim that the subsidies are a tax credit offsetting federal payroll taxes paid by low-income individuals. This obscures two obvious facts. First, low-income individuals on average get all their payroll taxes back in the form of pension and entitlement benefits – in fact, they already get more back than they pay in, which is why Medicare and Social Security are in such financial distress. Second, the size of the subsidy – averaging $5,210 per person in 2016 – will be FAR more than most low-income individuals will pay in payroll taxes each year.

The bottom line: The vast majority of the spending on insurance subsidies is NOT a tax cut – it’s yet more government spending on an unsustainable new entitlement.

Democrat spin aside, the facts reveal that the mandate represents a massive tax increase on millions of struggling middle-class Americans – both those directly paying the mandate tax, and those forced to buy health insurance to avoid the mandate tax. And Obamacare’s supposed “tax cuts” are nothing more than unsustainable new entitlement spending, funded by tax increases elsewhere in the legislation. No matter how you slice it, that’s not health reform.