Will One in Six Firms Drop Coverage?

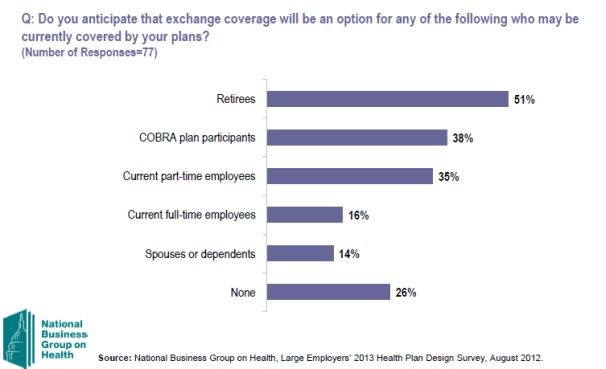

While we wrote earlier this week about how the National Business Group on Health’s annual survey found premium costs for businesses continue to rise, one element of the study missed our attention. That’s the high percentage of firms that are looking to dump coverage for some or all of their plan participants. As the below graph from the Business Group survey shows, a majority of large employers surveyed (51%) plan on dumping their retiree coverage, more than a third (35%) plan to dump coverage for part-time workers, and one-sixth (16%) plan to dump coverage for full-time employees:

When thinking about these data, it’s important to keep in mind two key facts. First, the Business Group’s members are “primarily Fortune 500 companies and large public sector employers” – in other words, large employers most likely to keep offering coverage. So the numbers above may actually be an under-estimate of the percentage of firms who actually dump, if a greater percentage of small and medium-sized businesses do so. Second, the Congressional Budget Office earlier this year examined scenarios where up to 20 million people lose employer-sponsored health insurance. But with 170 million people currently receiving employer-sponsored insurance, if one-sixth of firms drop coverage for their full-time workers – to say nothing of more firms dropping coverage for part-time workers and/or retirees – many more than 20 million people could lose their insurance, and the fiscal impact would be much greater.

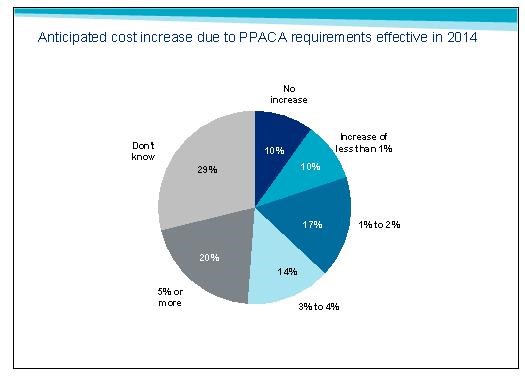

With a Mercer study released yesterday indicating that at least 61% of firms believe Obamacare will raise their health costs – and more than a third (34%) asserting the law will raise premiums by more than 3% – it’s obvious that businesses will look at ways to reduce their overall costs. Dumping their employees on Obamacare Exchanges would be one way for them to achieve this objective. Unfortunately, however, it would also saddle taxpayers with trillions of dollars in new obligations for years to come.