How Will Senate Health Bill Lower Premiums? Corporate Welfare

When the Congressional Budget Office (CBO) releases its estimate of Senate Republicans’ Obamacare discussion draft this week, it will undoubtedly state that the bill will lower health insurance premiums. A whopping $65 billion in payments to insurers over the next three years virtually guarantees this over the short-term.

Indeed, Senate Republican staff have reportedly been telling members of Congress that the bill is designed to lower premiums between now and the 2020 election—hence the massive amounts of money for plan years through 2021, whose premiums will be announced in the heat of the next presidential campaign.

Second, conservatives should consider what will happen four years from now, once the $65 billion has been spent. Ultimately, throwing taxpayer money at skyrocketing premiums—as opposed to fixing it outright—won’t solve the problem, and will instead just create another entitlement that health insurers will want to make permanent.

Where That Figure Comes From

Section 106 of the bill creates two separate “stability funds,” one giving payments directly to insurers to “stabilize” state insurance markets, and the second giving money to states to improve their insurance markets or health care systems. The insurer stability fund contains $50 billion—$15 billion for each of calendar years 2018 and 2019, and $10 billion for each of calendar years 2020 and 2021. The fund for state innovation contains $62 billion, covering calendar years 2019 through 2026.

Some have stated that the bill provides $50 billion to stabilize health insurance markets. That actually underestimates the funds given to health insurers in the bill. A provision in the state innovation fund section—starting at line 21 of page 22 of the discussion draft and continuing through to line 7 of page 23—requires states to spend $15 billion of the $62 billion allotted to them—$5 billion in each of calendar years 2019, 2020, and 2021—on stabilizing health insurers. (So much for state “flexibility” from Republicans.)

The Potential Impact on Premiums

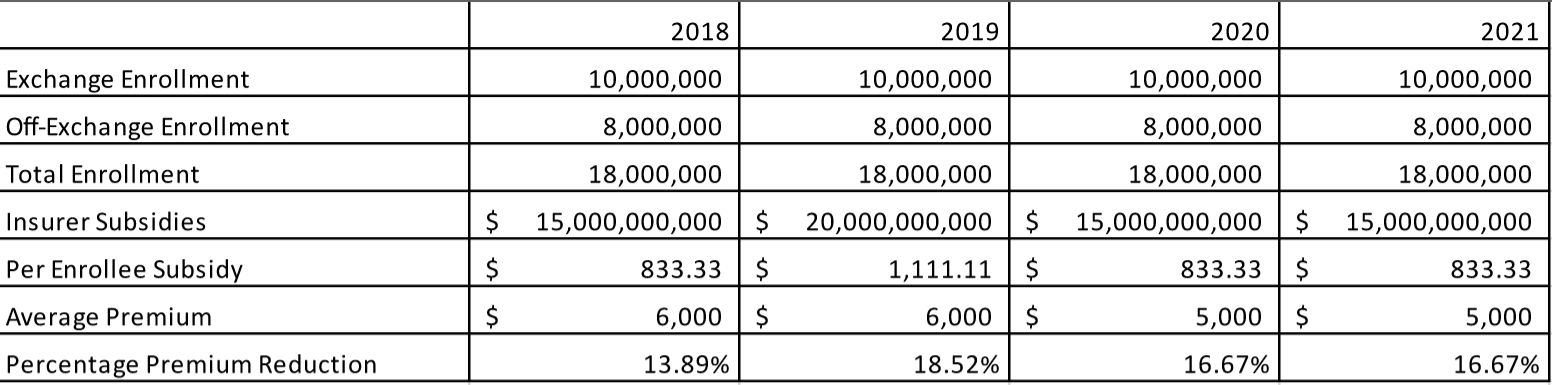

What kind of per-person subsidy would these billions generate? That depends on enrollment—the number of people buying individual insurance policies, both on the exchanges and off. Earlier this month, the administration revealed that just over 10 million individuals selected a plan and paid their first month’s premium this year, and that an average 10 million Americans held exchange plans last year. Off-exchange enrollment data are harder to come by, but both the Congressional Budget Office and blogger Charles Gaba (an Obamacare supporter) estimate roughly 8 million individuals purchasing individual market plans off of the exchange.

On an average enrollment of 10 million—10 million in exchanges, and 8 million off the exchanges—the bill would provide an $833 per enrollee subsidy in 2018, 2020, and 2021, and $1,111 per enrollee in 2019. In all cases, those numbers would meet or exceed the average $833 per enrollee subsidy insurers received under Obamacare’s reinsurance program in 2014, as analyzed by the Mercatus Center last year.

How much would these subsidies lower premiums? That depends on the average premium being subsidized. For 2018 and 2019, premium subsidies would remain linked to a “benchmark” silver plan, which this year averages $5,586 for an individual. However, in 2020 and 2021, the subsidy regime would change. Subsidies would be linked to the median plan with a lower actuarial value—roughly equivalent to a bronze plan, the cheapest of which this year averages $4,392.

The bill therefore should—all else equal—reduce premiums by at least 15 percent or so, solely because of the “stability” payments to insurers. However, other changes in the bill may increase premiums. Effectively repealing the individual mandate by setting the penalty for non-compliance to $0, while not repealing most of the major Obamacare regulations will encourage healthy individuals to drop coverage, causing premiums to rise.

If CBO finds that the bill won’t reduce premiums by at least 15 percent, it’s because it doesn’t actually repeal the insurance mandates and regulations driving up premiums. The “stability” funding is simply using government funding to mask the inflationary effects of the regulations, at no small cost to taxpayers.

What About After the Presidential Election?

But what happens in years after 2021, when “stability” funding drops off by 75 percent? How “stable” is a bill creating such a dramatic falloff in insurer payments? How will such a falloff not create pressure to create a permanent new entitlement for insurers, just like insurers have pressured Republicans to create the “stability” funds after Obamacare’s “temporary” reinsurance program expired last year?

More than four decades ago, Margaret Thatcher properly pointed out that the problem with socialism is that it eventually runs out of other people’s money. Throwing money at insurers may in the short term bail them out financially and bail Republicans out politically. But it’s not sustainable—nor is it a substitute for good policy.

This post was originally published at The Federalist.