Why Doesn’t Anyone Ask Joe Biden Why He’s Dodging Obamacare Taxes?

A few hours before the first presidential debate of the 2020 general election campaign, and amid a full-blown media kerfuffle over Trump’s taxes, the Democratic nominee released his 2019 tax returns. The timing of the release seemed far from coincidental: ahead of the debate, so Biden could say he made his returns public, but without giving reporters and moderator Chris Wallace time to absorb the returns prior to the debate. It seems Biden was hoping the details of his returns would become old news immediately after Tuesday evening.

Reporters should dig into Biden’s tax returns, however, in the same way they have shown a seemingly unquenchable curiosity regarding Trump’s, for one reason: Biden claims to support Obamacare — but has consistently avoided paying Obamacare taxes.

You read that right. I noted last year that Biden’s 2017 and 2018 returns showed a tax avoidance strategy that allowed him to circumvent over half a million dollars in Medicare and Obamacare taxes. According to their own returns, Biden and his wife Jill did the same thing in 2019.

The Strategy, Explained

Since the vice president left government service in early 2017, the Bidens funneled their income from book royalties and speaking fees through two corporations: CelticCapri Corporation and Giacoppa Corporation. They paid themselves modest salaries through the corporations, on which they paid full Social Security and Medicare taxes.

The Bidens took most of this book and speech income — over $13.5 million — not as wages, however, but as profits from the two corporations. Taking that income as corporate profits allowed them to avoid payroll taxes on the $13.5 million.

Because Social Security taxes only applied to the first $132,900 of income in 2019, the Bidens didn’t avoid paying the taxes that fund that program. But the 2.9 percent Medicare tax applies to all income, and the 0.9 percent “high-income” tax created in Section 9015 of Obamacare applies to all wage income over $200,000 for an individual or $250,000 for a family.

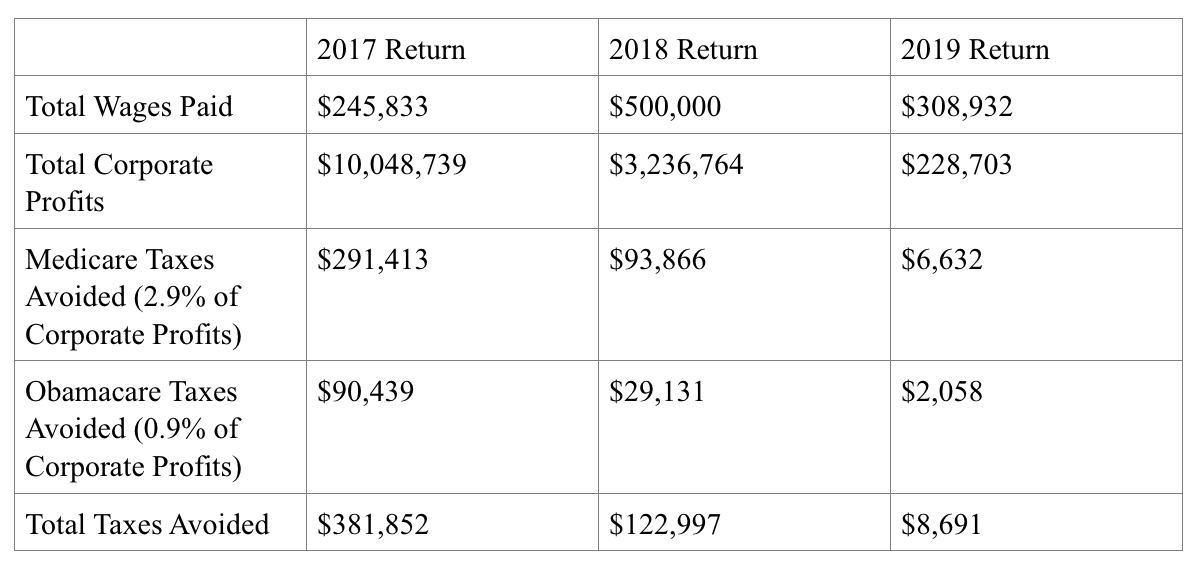

Taking their income as corporate profits allowed the Bidens to avoid paying this combined 3.8 percent payroll tax on the more than $13.5 million in income they received from 2017 through 2019. This chart lays out the details:

The tax avoidance strategy saved them less in 2019 than in prior years. On the other hand, Biden earned much less last year, likely due to curtailing paid speaking appearances once he began his presidential campaign.

To most ordinary Americans, however, the Bidens still circumvented a staggering amount of taxes: $513,540 in total over the three years. Whereas the Bidens avoided $391,912 in Medicare taxes from 2017 through 2019, the Urban Institute found that a couple with average earnings, retiring this year, would pay a combined $161,000 in Medicare taxes their entire working lives.

Biden’s Hypocrisy — and Democrats’ Silence

Even as he released another set of tax returns showing his continued willingness to circumvent Obamacare taxes, the Biden campaign continues to run ads in which Biden claims Obamacare “is personal to me.” Democrats want to run on the law this fall, believing that fears over the Obamacare lawsuit pending at the Supreme Court will motivate their voters. But how personal can Obamacare be to Biden if he went out of his way to avoid Obamacare taxes?

Likewise, the Democrats attempting to subpoena Trump’s tax returns should answer a simple question: If they want those returns for nonpartisan oversight purposes, why haven’t they called for an Internal Revenue Service audit of Biden’s taxes? Particularly in 2017, Biden paid himself a paltry salary compared to the $10 million in corporate profits he received, an arrangement that might violate IRS compensation guidelines.

The deafening silence from the liberal media notwithstanding, the real questions about Biden’s taxes won’t go away, nor should they. The American people have a right to know from “Middle-Class Joe” himself why he put his own financial self-interest over a law he supposedly cares so much about.

This post was originally published at The Federalist.