Inconvenient Truths for Democrats on Medicare’s Solvency

On Feb. 2, a subcommittee of the Senate Finance Committee chaired by Sen. Elizabeth Warren, D-Massachusetts, will hold a hearing on Medicare’s Hospital Insurance Trust Fund and its finances. On the one hand, the hearing provides an opportunity to examine America’s entitlement crisis, and the reforms needed to make Medicare (along with Social Security and Medicaid) solvent and sustainable in the long term.

However, given Democrats’ longstanding history of using Medicare as a slush fund to finance their big-government expansions, one shouldn’t expect lawmakers like Warren to advocate proposals that would achieve fiscal solvency or even fiscal sanity. Here are five ways in which Democrats have made or would make Medicare’s problems worse.

1. Medicare Is Already Functionally Insolvent

Officially, the Medicare program’s trustees calculate 2026 as the year in which the Hospital Insurance Trust Fund will reach insolvency, making it unable to pay its bills. But in reality, that trust fund became functionally insolvent several years ago.

In 2009, the last year before Obamacare’s enactment, the Medicare trustees estimated an insolvency date of 2017 (i.e., five years ago). Obamacare changed the program’s insolvency date only on paper, as that law saw Democrats counting Medicare savings twice—once to pay for Obamacare, and once to “save” the trust fund.

Not only did Democrats’ raid on Medicare—to the tune of $716 billion—not functionally improve Medicare’s solvency. By giving lawmakers an excuse to ignore Medicare’s fundamental problems for the past decade-plus, it allowed those problems to metastasize and worsen.

2. Democrats Want to Raid Medicare to Pay for Build Back Bankrupt

The $5 trillion reconciliation bill Democrats rammed through the House last fall would use savings from Medicare drug pricing to fund other parts of their big-spending agenda, like “free” pre-K and another round of expanded Obamacare subsidies.

According to scores from the Congressional Budget Office, the House-passed bill diverts a net of nearly $266 billion of current Medicare spending to pay for other programs in the reconciliation measure. Even if one discounts the supposed Medicare savings from a repeal of the Trump administration’s rebate rule—which never went into effect, and never will—as a phony budget gimmick (as I do), the measure would still divert more than $123 billion in Medicare spending towards other programs.

3. Joe Biden Contributed to Medicare’s Insolvency by Dodging Medicare Taxes

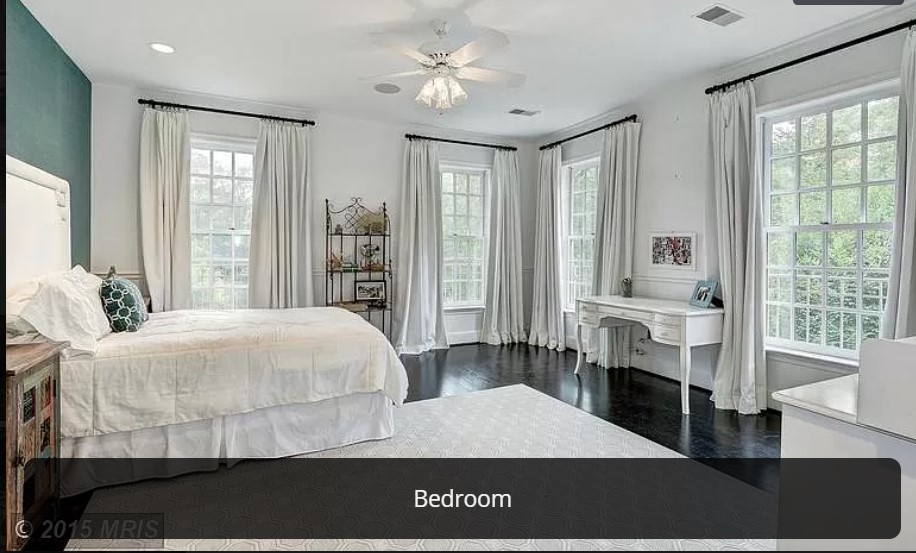

As I have previously outlined, President Biden used a loophole—one that his Treasury Department now wants to abolish, because it allows wealthy people to avoid paying their fair share—to dodge more than half a million dollars in Medicare and Obamacare taxes. At the same time he was dodging these taxes, he rented this mansion outside Washington, showing how he puts his own luxury lifestyle ahead of funding health care for his fellow seniors:

Tax experts have called Biden’s maneuvers not just hypocritical, but potentially illegal, because Biden paid himself an inappropriately low salary to avoid paying Medicare and Obamacare taxes on his book and speech income. So if Warren and leftists like her really care about taxing the rich, and improving Medicare’s solvency, they should ask why the IRS declined to audit Biden’s tax returns for the years when he was engaging in this questionable conduct—or, better yet, pass legislation forcing the IRS to go back and audit Biden’s returns.

4. Bill Would Make Medicare’s Solvency Problems Worse

Lawmakers, including some Republicans, are currently considering postal “reform” legislation that would accelerate Medicare’s insolvency. Bills in the House and Senate would require all eligible postal retirees to join the Medicare program (right now, about one-quarter do not).

Forcing postal employees into the Medicare program would definitely lower the Postal Service’s obligations for retiree health care. But the proposal would shift individuals from a postal retiree program scheduled for insolvency in 2030 into a Medicare program scheduled for (official) insolvency in 2026. Absent structural reforms to Medicare, this move makes little sense, and amounts to little more than shifting deck chairs on the Titanic.

5. Elizabeth Warren Wants to Abolish Medicare

It’s particularly rich that Warren will chair this subcommittee hearing, given her prior sponsorship of the single-payer health care bill offered by Sen. Bernie Sanders, I-Vermont. Section 901(a) of that bill, introduced in 2019, included the following language:

(1) IN GENERAL.—Notwithstanding any other provision of law…

(A) no benefits shall be available under title XVIII of the Social Security Act for any item or service furnished beginning on or after the effective date of benefits under Section 106(a) [four years after enactment].

Title XVIII of the Social Security Act refers to the current Medicare program. In other words, the legislation Warren has co-sponsored would abolish the current Medicare program, while also liquidating the current Medicare trust funds. That’s Warren’s plan for seniors’ health security—not “Medicare for All,” but “Medicare for None.”

Democrats’ Big-Government Slush Fund

I noted in my book on single-payer the ironic nature of Warren’s and Sanders’ positions: “Abolishing the current Medicare program to fund wealthy individuals’ health care sounds like the kind of accusatory claim that a socialist like Sanders would level against Republicans. But in reality, his single-payer legislation would do just that.”

But in reality, all Democrats, even those who have not endorsed Sanders’s legislation, take a similar approach. To the left, Medicare isn’t a sacred obligation to retirees that lawmakers should prioritize and protect, but another program to be raided whenever Democrats have a chance. To sum up their position in two words: Seniors, beware.

This post was originally published at The Federalist.