CBO Reports Show Economic Harms of Socialized Medicine

As if America’s current economic malaise didn’t create enough problems, several reports demonstrate how Democrats’ agenda for single-payer health care would make it worse.

The reports by the Congressional Budget Office (CBO) quantify the ways single-payer would result in lower economic growth and a reduced labor supply. The analyses reinforce the notion that progressives’ “equity” agenda won’t raise lower-income citizens’ proverbial boats so much as drop all Americans into a lifestyle of stagnation.

Five Single-Payer Options Examined

The reports, the most recent of which was released in late February, follow up on an initial volume released in December 2020. That 200-plus page CBO analysis concluded that, among other things, all options the budget office examined would create an increased demand for care that the single-payer system could not meet, leading to government rationing of health care.

As with the earlier report, CBO analyzed five separate theoretical single-payer health systems, to determine their various effects: One with comparatively high reimbursement levels (for doctors, hospitals, and drugs) and high cost-sharing (e.g., deductibles and co-payments); one with low reimbursement levels and high cost-sharing; one with high reimbursement levels and minimal cost-sharing; and one with low reimbursement levels and minimal cost-sharing. A fifth option included coverage of long-term supports and services (LTSS), whether provided in institutions (i.e., nursing homes) or in the home.

Economic Effects of Single Payer

The February 2022 report examined CBO’s views of how six separate phenomena associated with a single-payer system would affect the broader economy:

- Eliminating employer-provided health coverage would cause firms to raise wages, in CBO’s view, increasing gross domestic product by increasing the labor supply (workers working more hours) and capital stock (workers saving more).

- Reducing or eliminating cost-sharing—even the “high” cost-sharing option would eliminate insurance premiums, resulting in out-of-pocket savings when compared to the current system—would reduce GDP by discouraging work (workers feel wealthier) and lowering the capital stock (workers saving less).

- Lowering administrative costs would, in CBO’s estimation, increase GDP by improving productivity, households’ after-tax wages, savings, and capital stock.

- Lowering providers’ reimbursement rates would increase GDP by improving overall productivity—although these gains would take time to accumulate, as CBO assumes half of lower reimbursement rates would get passed through to health-care workers in the form of lower wages.

- Improving health outcomes would in CBO’s view increase GDP by improving worker productivity and growing the labor force.

- In the option with an LTSS benefit, coverage of these services would reduce GDP by creating a wealth effect that causes people to work less. However, some currently-unpaid caregivers could get paid for their hours, or work at other, higher-paying jobs, mitigating the reductions in the labor supply that would dent economic growth.

Overall, CBO found that the various options presented would increase GDP by as much as 1.8 percent per year by 2030, with only the option including LTSS resulting in a slight (0.3 percent) reduction in economic growth. In all cases, private non-health consumption grows by 10-12 percent per capita by decade’s end.

I’ll admit: On their own, those results sound reasonably appealing. But as you might expect, there’s a catch—and it’s a big one.

Job-Killing Tax Increases

CBO’s February 2022 report examined only the effects of the single-payer system itself, not the financing for that system. To examine the effects of single-payer on the private sector, its model had to hold total government spending constant, and therefore essentially assumed single-payer would get funded from elsewhere within the federal budget.

That’s an understandable assumption for a modeling exercise, but making huge cuts to things like Social Security and defense spending to pay for a new socialized medicine scheme isn’t a politically realistic option, nor one progressives pushing for single-payer would support. And a prior CBO report from last March that examined the tax increases necessary to fund the level of spending a single-payer system would require shows the economic pain that would result.

As with its other papers, CBO analyzed several potential ways to raise enough revenue to fund a single-payer system: A flat tax on labor (similar to the Medicare payroll tax); a flat tax on all income that would apply to both labor (i.e., wages) and capital (i.e., capital gains); and a progressive tax on all income.

The report makes for bracing reading. Funding an increase in spending equal to 10 percent of GDP—the cost of the most robust single-payer option—by an increase in labor taxes alone would require the average tax rate paid on labor income to more than double, from 17.7 percent in 2020 to 38.4 percent in 2030. Conversely, using a progressive income tax that applies to both labor and capital would triple capital gains average rates, from 15.4 percent in 2020 to 45.4 percent in 2030.

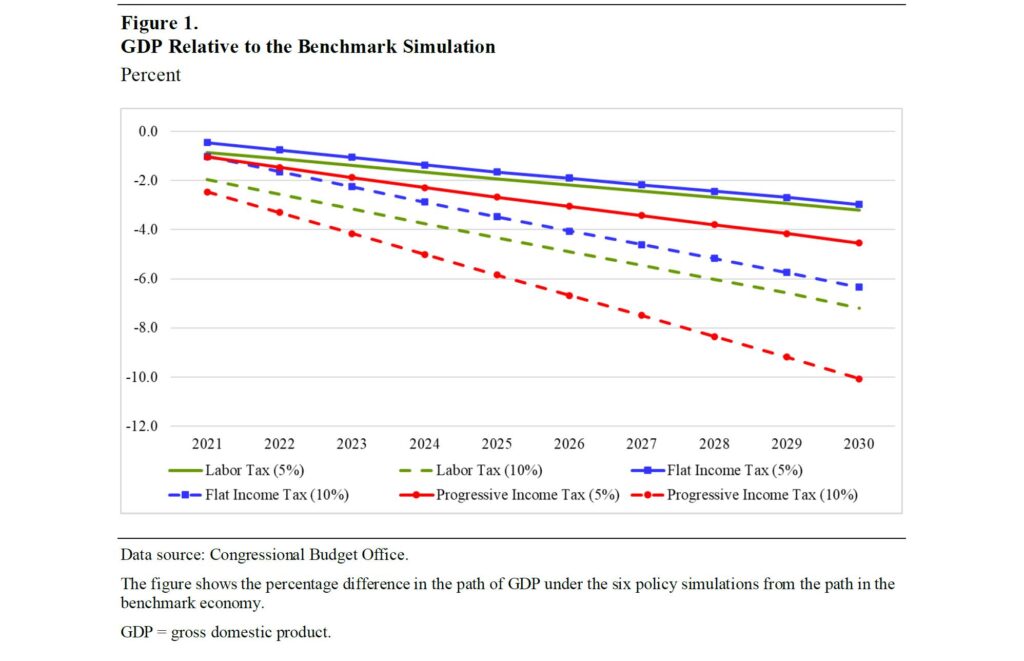

As for the economic effects of all these tax increases, this figure from CBO’s report last March speaks for itself:

Given this across-the-board drop in economic growth, little wonder that CBO’s report this February concluded that—even after taking into account the supposed benefits of single-payer in isolation—the program, when combined with its funding mechanism, “would reduce GDP by 2030 by between 1.0 percent and 10.0 percent” depending upon the details of each. CBO also noted that “hours worked would be lower for most households across the income distribution,” regardless of the specifics of the system implemented.

Economic Hari-Kari

It’s enough to wonder why a place like California would even think about voting on a single-payer system as recently as a few short weeks ago. The nation continues to suffer from a nationwide labor shortage, yet California legislators wanted to pass legislation that would further reduce the labor supply—and crush economic growth for years to come.

At the last minute, lawmakers in Sacramento mercifully came to their senses for once, shelving the single-payer legislation for this year. Residents should hope that its death becomes as permanent as it was quick.

This post was originally published at The Federalist.