Joe Biden, Who Dodged Obamacare Taxes, Now Proposes Expanding Obamacare

For all his claims of fiscal responsibility, President Biden has a funny way of showing it. His administration just proposed legally questionable regulations that would increase deficit spending by tens of billions of dollars.

Why did he drive up the deficit, as well as inflation, on this particular occasion? To prop up a law, Obamacare, that Biden went out of his way to avoid funding out of his own pocket.

Eligibility for Insurance Subsidies

The administrative change involves eligibility for federal insurance subsidies offered on state exchanges. Under current law, households do not qualify for subsidies if they have an offer of “affordable” employer coverage, as applied to coverage for the employee only. Democrats call this provision the “family glitch,” because spouses and dependents cannot receive subsidies so long as an employer offers “affordable” coverage for the worker, even if that employer does not subsidize or offer insurance for family members.

The recently published rule would change the current eligibility criteria. Under the proposal, spouses or dependents could qualify for federally subsidized coverage if they do not have an offer of “affordable” family or self-plus-one coverage.

The rule says nothing about the cost of this change, and on a background call with reporters, administration officials wouldn’t directly answer a question about “how much [the change] is going to cost and how it will be paid for.” But in June 2020, the Congressional Budget Office estimated that altering this provision in statute would raise federal spending by $45 billion over ten years.

Therein lies the real reason for enacting this change via regulation instead of by statute. Neither last spring’s Covid spending bill, which temporarily increased Obamacare subsidies for 2021 and 2022, nor any versions of the $5 trillion Build Back Bankrupt bills Congress considered last fall, contained language regarding this provision. Democrats want to enact the change via the regulatory process, the better to jam even more items into their legislative spending binge.

Another Illegal Regulation?

But the Biden administration may not have the authority to order such a change unilaterally. The section of Obamacare in question specifically cross-references affordability to the relative cost of “self-only coverage”—i.e., coverage for the employee alone. The Joint Committee on Taxation’s spring 2010 summary of the law notes that even if family coverage exceeds the affordability threshold, “the family does not qualify for” subsidies, provided that self-only coverage for the employee meets the statutory standard.

Given that legislative history, the Obama administration in February 2013 published a final rule linking subsidy eligibility to affordability for self-only coverage. The recently released rule concedes the tenuous nature of the Biden administration’s new position. In an unusual move for a regulatory proposal, the rule explicitly includes a severability clause designed to preserve portions of the rule if some elements get struck down in court.

Didn’t Want to Fund Obamacare Himself

Biden’s willingness to expend billions of dollars on unilateral changes to Obamacare contrasts with his personal behavior regarding the law. From 2017 through 2019, Biden funneled most of his book and speech income through an S-corporation, using a legally questionable loophole to avoid paying more than $100,000 in payroll taxes imposed by Obamacare.

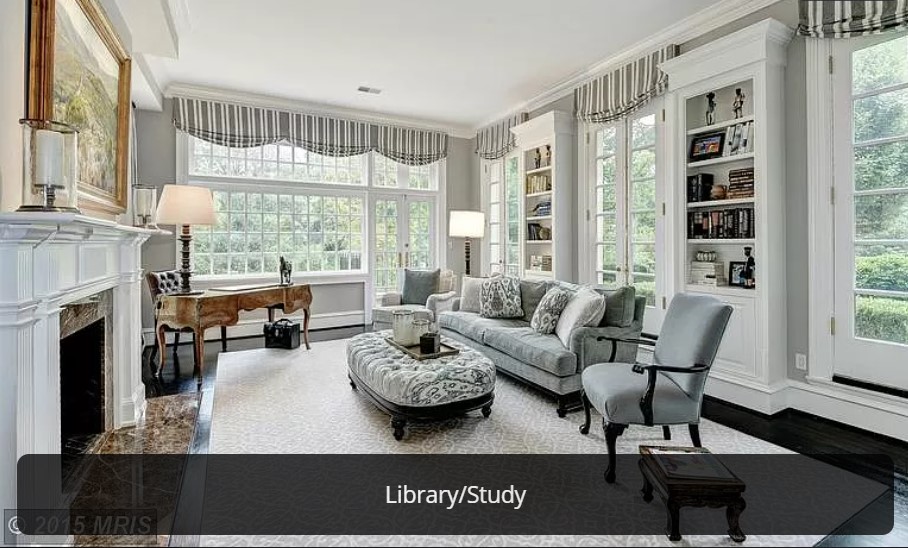

What did Biden spend his money on instead of paying a six-figure sum of Obamacare taxes? At the same time as he embarked on his tax evasion activities, Biden bought a multi-million-dollar beach house, and rented this mansion just outside Washington:

With the federal government more than $30 trillion in debt, Biden’s Obamacare actions bring to mind Margaret Thatcher’s famous axiom: “Socialist governments traditionally do make a financial mess. They always run out of other people’s money.”

This post was originally published at The Federalist.