Budget Office Shows How Washington Has Drowned America in a Sea of Red Ink

If you think our current fiscal situation, with $2 trillion deficits, looks bleak, the recent Congressional Budget Office (CBO) outlook for the years ahead has news for you: You ain’t seen nothing yet.

As it has for many years, the document shows a fiscal situation slowly spiraling out of control. And while some have tried to put a positive spin on things by claiming the situation is “better” (really just slightly less bad) than last year, Congress is soon poised to make the situation worse by passing yet another spending blowout in the weeks ahead.

Historic Deficits and Debt

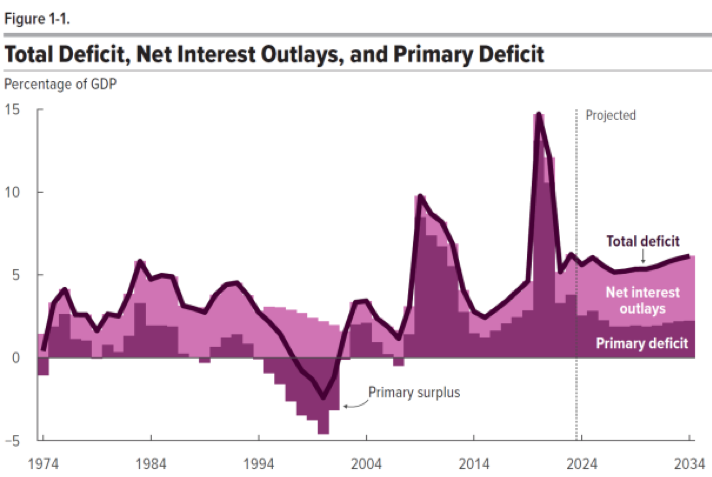

Excluding the effects of various timing shifts, CBO projects the deficit will total “only” about $1.6 trillion in the fiscal year ending Sept. 30. That deficit amounts to 5.6 percent of the size of the economy. The budget office forecasts that deficits will remain above 5 percent of GDP for the next decade. And no, this level of red ink is NOT normal:

The deficits that CBO projects are large by historical standards. Over the past 50 years, the annual deficit has averaged 3.7 percent of GDP. In CBO’s projections, deficits equal or exceed 5.2 percent of GDP in every year from 2024 to 2034. Since at least 1930, deficits have not remained that large for more than five years in a row.

Remember too that CBO’s projections assume all the income tax reductions included in the 2017 tax law expire at the end of next year, as scheduled. In other words, CBO is projecting historically large deficits even after one of the largest tax increases in American history takes effect in 2026.

Why the persistently high deficits? Two major reasons lie in the Covid spending binge. That pandemic spending 1) increased our overall debt and 2) forced the Federal Reserve to raise interest rates to combat the inflation all this spending wrought. A CBO chart makes clear the dramatic increase in federal deficits over the last few years, along with the record-high amounts we are projected to spend on interest rates in the coming decade:

As of this fiscal year, net interest costs will exceed the entire defense discretionary budget. In other words, we will spend more dollars paying off prior years’ spending than we will to keep our country safe from today’s threats. If that’s not a threat to Americans’ security, I don’t know what is.

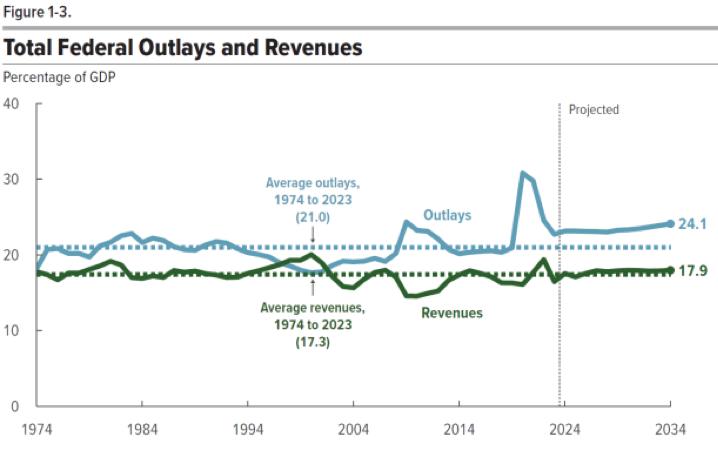

But even apart from interest costs, the primary deficit — that is, the deficit in the current fiscal year, without counting interest costs to pay off prior years’ debt — remains historically high. And that deficit remains high not because projected revenues shrink, either. As another CBO chart demonstrates, large deficits persist because government spending remains well above historical averages, due in large part to ever-growing spending on mandatory programs like Social Security, Medicaid, and Medicare:

‘Improvement’ Is a Mirage

At this point, some might recall that House Republicans got President Biden to agree to a debt limit bill last spring that (theoretically) curbed spending. Won’t that help the situation?

In theory, it would if Republicans actually stuck to the agreement. But Republicans have already said they don’t want to stick to the agreement, which is why House Speaker Mike Johnson, R-La., cut his (bad) spending deal with Biden earlier this year.

Because the budget office has to assume the continuation of current law and policies, the deficit estimates above assume that spending caps included in the budget agreement remain. But if — more like when — Congress busts through the caps to pass spending bills in March at higher levels than the caps, fund additional military/foreign aid, or both, much if not all of the supposed $2.6 trillion in projected deficit reduction from caps in the debt limit bill will evaporate.

And when that does happen, the fiscal situation will become not just worse than CBO’s estimates this year, but worse than CBO’s projections from last year. Since releasing its last round of estimates in May, the budget office raised the projected deficit effects of economic and technical changes to the budget. Those changes include things like higher interest rate costs, as well as the Biden administration’s unilateral actions that expanded student “loan forgiveness” and raised the cost of “green” pork/subsidies to $1 trillion.

Only the supposed savings from the spending caps have prevented the $1.3 trillion in higher costs from the economic and technical changes from worsening the federal government’s financial position. When those spending cap savings evaporate, like most other “savings” Congress claims to enact, projected deficits will rise even higher.

One hopes that seeing the numbers in the CBO report will prompt members of Congress to rethink their strategy of busting through the spending caps they negotiated just last spring. Even if they don’t, however, events will soon force lawmakers’ hands. But because Washington seems insistent on controlling spending the hard way, quite possibly via a debt crisis causing dramatic disruption to our economy, rather than the easy way, the American people will end up much worse off.

This post was originally published at The Federalist.